MDVIP is a top-rated executive health program, according to Worth magazine. Of those recognized, MDVIP is the only program to have a nationwide network of affiliated physicians. Our affiliated physicians also provide follow-up care and wellness planning, which can result in meaningful health outcomes. In addition, MDVIP’s program is different because members of MDVIP-affiliated practices enjoy conveniences not found in most primary care practices such as 24/7 doctor availability by phone and same- or next-day appointments that start on time.

As members of MDVIP-affiliated practices, your executives will take part in the annual MDVIP Wellness Program, which includes comprehensive, advanced screenings and diagnostic tests not typically covered by commercial insurance. Our Wellness Program, comparable to an executive physical, addresses key areas such as heart health, diabetes, respiratory health, bone health, nutrition, fitness, emotional well-being, hearing, vision, weight management, sleep and management of chronic illness.

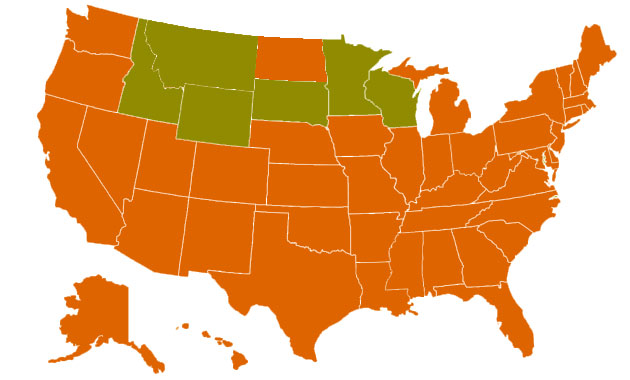

We currently have over 1,100 MDVIP-affiliated physicians practicing in 45 states and Washington DC.

No. They can choose to keep their current doctor and still take advantage of having an MDVIP-affiliated physician perform their annual wellness services.

Choosing a doctor is based on personal preference (i.e., training or proximity to your home or workplace).

Your employees can find information about all the doctors in our national network, including their professional credentials, education and training. We encourage your employees to contact the practice and schedule a face-to-face appointment to meet the doctor and discuss their personal health goals and objectives to decide if that MDVIP-affiliated physician is the right one for them.

Yes. If your company doesn’t pay the full cost of a membership, your employees can use their pre-tax corporate plans to pay for the fee. After they have received their annual wellness services, the yearly fee may generally be reimbursed by flexible spending accounts (FSAs), medical savings accounts (MSAs), health reimbursement accounts (HRAs), and health savings accounts (HSAs). Please note that the fee cannot be paid using an FSA debit or credit card.

No. The MDVIP program is a complement to existing health insurance.

Employees will still need health insurance to cover all other medical services unrelated to the wellness program, including sick visits, specialty consults, diagnostic tests, outpatient procedures and hospital stays. Co-pays, deductibles and co-insurance of their existing benefit package would apply to all healthcare services provided outside of the annual MDVIP Wellness Program.

Our doctors also perform additional services beyond the MDVIP Wellness Program, which may be covered by insurance.

The annual fee for individual memberships in MDVIP-affiliated practices is generally between $2,500 and $5,000, based on location. You can discuss specific pricing with MDVIP's executive health team at 844-393-6070.

MDVIP-affiliated internal or family practice physicians will usually treat your children (between the ages of 16 to 25) for routine office visits or sick care without any additional membership fee. This may vary, so please check with your MDVIP-affiliated doctor. Also note that standard fees, insurance co-pays, coinsurance or deductibles may apply.

No, MDVIP-affiliated physicians limit their practice to MDVIP members only so they can focus their time and attention on them exclusively.